Federal Tax Updates 2024. While 2023 did not see major. Effective jan 1 2024, irs has updated the federal tax brackets.

On april 16, 2024, the federal government presented its 2024 budget “fairness for every generation” in the house of commons. In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024, including the tax rate schedules and other tax changes.

Tax rates for the 2024 year of assessment Just One Lap, Washington — the irs encourages tax professionals to register now for the 2024 irs nationwide tax forum, coming this summer to chicago, orlando,. One highlight of the mop.

2024 Federal Tax Brackets And Rates Rasla Cathleen, 2024 federal income tax brackets and rates. Keep your federal tax planning strategy on track with key irs filing dates.

2024 Easy Federal Tax Update • 8 Hrs CPE Credit, 10%, 12%, 22%, 24%, 32%, 35% and 37%. On april 16, 2024, the federal government presented its 2024 budget “fairness for every generation” in the house of commons.

Irs Tax Filing 2024 Sadie Collette, Effective jan 1 2024, irs has updated the federal tax brackets. Our 2024 tax calendar gives you a.

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, India’s direct tax collections surge 17.7% in fy24 to ₹19.58 tn. The 2024 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

Federal Tax Brackets 2024 Single Mela Stormi, One highlight of the mop. Our 2024 tax calendar gives you a.

What the New Federal Tax Brackets and Standard Deductions Mean for You, 2024 federal income tax brackets and rates. The income tax brackets for individuals are much wider for 2024 because of inflation during the 2023 fiscal year.

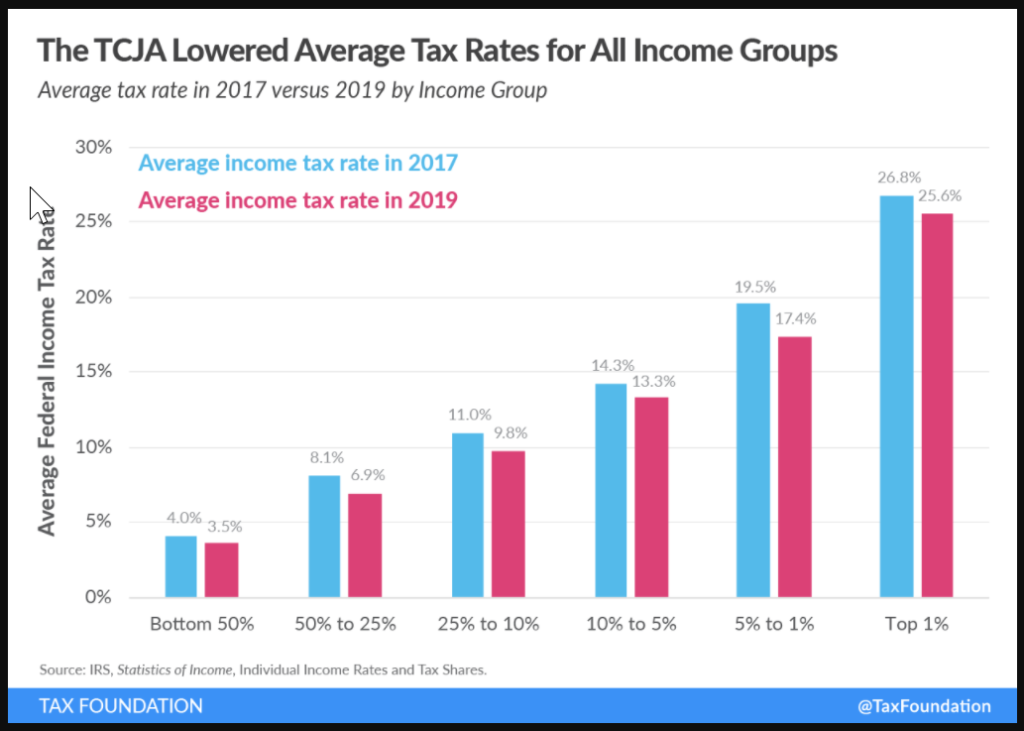

The 20232024 Federal Budget Updates Key Tax Measures, Washington — the irs encourages tax professionals to register now for the 2024 irs nationwide tax forum, coming this summer to chicago, orlando,. 2024 is in full swing on capitol hill with the introduction of a new $70 billion tax package to revive child tax credits, the tax cuts and jobs act (tcja), and more.

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 10%, 12%, 22%, 24%, 32%, 35% and 37%. The irs has announced that there will be a 5.4% bump in income thresholds to reach each new tax bracket.

Summary of the Latest Federal Tax Data, 2022 Update Actuarial News, There income brackets for marginal tax rates were. 10%, 12%, 22%, 24%, 32%, 35% and 37%.